Gone are the long queues to withdraw cash and update bank passbooks. It is highly likely that the future generations will not know what a bank passbook is or how long it took to update it.

Last week, we looked at how Ed-Tech is revolutionising education. This week, let us look at how Fin-Tech is bringing about a new world order. Banking, finance as a whole, has transmogrified and climbing aboard the digital bandwagon.

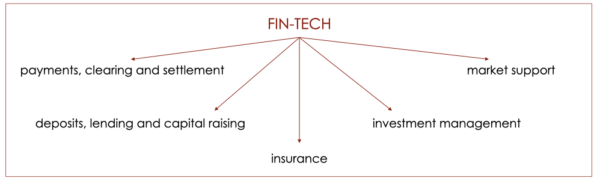

When it emerged, fin-tech referred to back-end tech that assisted the functioning of traditional financial organisations. Today, fin-tech has come up with so many end-user interfaces that serve customers directly. As Investopedia defines it, “Fintech now includes different sectors and industries such as education, retail banking, fundraising and nonprofit, and investment management to name a few. It also includes the development and use of crypto-currencies such as bitcoin.”

We’ve written before on what makes Fin-Tech work, why are venture capitalists rushing to invest in fin-tech start ups and how it translates into career options for you. But what does it mean for the future?

Companies like Square and Stripe are already offering optimised checkout and payment systems wherein, for instance, a thumb print authorisation is sufficient across applications in a smart phone.

With Artificial Intelligence that can analyse big data, you can get objective investment advice from robots. It speeds up data processing and analysis, reduce human error and bias and cut down individual advisor costs. SoFi for instance offers automated investing and automated trading platforms for your investment needs. For beginners, applications like Stockpile allow low cost investing and managing custodial accounts.

Especially considering the hit global economy has taken due to the pandemic, Fin-Tech services that provide alternative lending options to individuals or businesses of varied sizes is a huge boon. The application, verification and approval processes are all made easier, thanks to blockchain technology. Take a look at Afterpay. With its “buy now, pay later” campaign, this company has become hugely successful by providing online POS instalment financing. It accesses the technological sweet spot created by increasing online purchasing and the general reluctance to increase credit card debt, especially in the middle of a pandemic. Prosper is a peer-to-peer lending market place. Upstart is another company that provides personal loans, without affecting your credit score. Fin-Tech has also made possible the the option of open and crowd funding for individuals, businesses and productions across industries.

After the gold rush, it is the crypto craze made possible by the growth in the Fin-Tech sector. Superior investment returns has made cryptocurrency one of the most discussed investment topics in 2020. When universalised, cryptocurrency can remove third party requirements when it comes to transferring funds. It can reduce transaction costs and has the potential for online voting and crowd funding.

The way growth right now is not towards Fin-Tech replacing banks or other conventional modes but a collaboration of the two to get the best of both worlds. The stability of banks with the tech advantage of the start-ups provide the best combination for its consumers. Convenience, remote transactions and global reach are the principles that govern the growth of the fin-tech sector.

The boom in this sector has implications all over. Every other industry is tied up to Fin-Tech in one way or another for its incomes and expenditures. From an end-user standpoint, a hotel reservation gets confirmed after payment online. An artist uploading his/ her work on Instagram or TikTok is also connected to Patreon, contributing to the creative economy. The growth of small businesses in other industries is also on the rise, thanks to the opportunities provided by startup Fin-Tech investment companies. In a way, the Fin-Tech boom is on its way to counter the economic decline caused by the pandemic. In the near future, we will see a closer integration of Fin-Tech platforms with the digitalisation of other industries.

![Best Universities in New Zealand for International Students [2025 Rankings]](https://tcglobal.com/wp-content/uploads/2025/09/Best-Universities-in-New-Zealand-for-International-Students-2025-Rankings-600x338.png)